Factoring and Financial Services

What's factoring?

Daphne

Jul 18, 2024

There is quite a bit of confusion about factoring. Generally speaking, factoring is nothing but a marketing term used to describe different types of services, usually (but not always) provided by financial institutions.

Although all these services are different, each individual seller or factoring company, calls it ‘factoring’ and then specifies it as traditional factoring, invoice factoring, American factoring, reverse factoring, service factoring, bulk factoring, silent factoring, (non-)recourse factoring and perhaps a few more.

With this article, we hope to give you a clear (and final) understanding of the mechanisms at work with the different types of factoring and how to properly identify each service when you are looking around in the market.

2 mainstreams, 4 basic elements

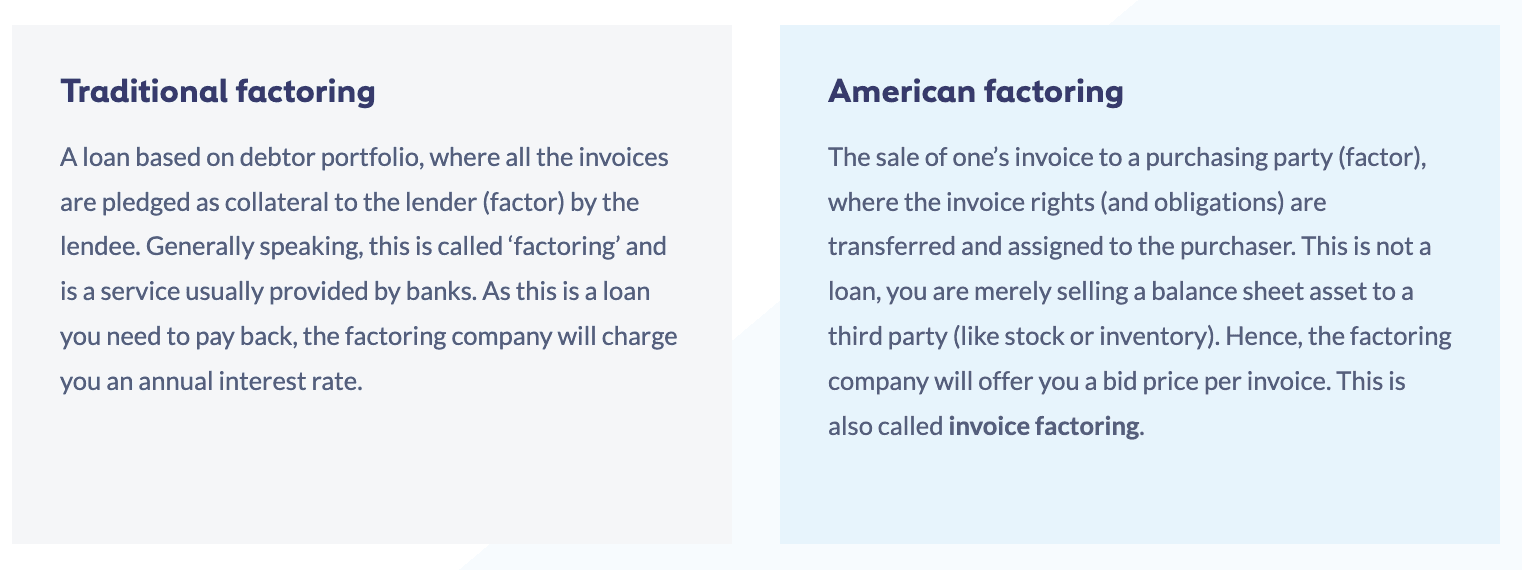

Every type of factoring consists of 1 mainstream in combination with 1 or more basic elements. Different combinations make different types of factoring. There are two mainstreams:

There are 4 basic elements. You need to take into account each one of them when you are applying for a quote with a factoring company.

The factor may or may not …

… register and manage accounts receivable

… (partially) purchase or finance the invoices

… monitor and collect the overdue invoices

… take over debtor credit risk

What does Finqle do?

We purchase invoices, so we use American factoring. Regarding the basic elements, we register, manage, (partially) purchase, monitor, collect, and take over debtor risk. So technically, we apply all four basic elements, although there are options to deviate from them if our client wishes to do so. This is called non-recourse American factoring. Non-recourse means there is no payback obligation. Of course, each party has to abide by some rules.

So how does it work?

You make a deal

You and your client negotiate a deal for you to deliver goods or services. It is up to you and your client to set the terms, such as:

Rates or fees

Start and end date

Method of delivery

Payment term of the invoice

You deliver

As per your deal or contract, you deliver your goods or services. Make sure you receive a proof of delivery. This will make your life a lot easier when you need to get your invoices paid. Important to notice here: yes, we will become the owner of the invoice once you sell it, but you remain responsible for properly performing the negotiated deal with your client.

Sell your invoice

You send your invoice to Finqle for assignment and transfer. Once all boxes are checked, Finqle purchases your invoice and pays out the bid price directly into your account. We then send the invoice to your client, who pays the invoice amount into our bank account within the due date.

Relax

Once we purchase your invoice, you can lean back and relax. As stated above, we provide the following services:

Cash in hand. Your invoice has been paid into your bank account

Credit management: We make sure your debtor pays the invoice on time

Credit insurance: We cover the invoice against bankruptcy

Monitoring: in our online application, you can monitor each step

How does that calculate?

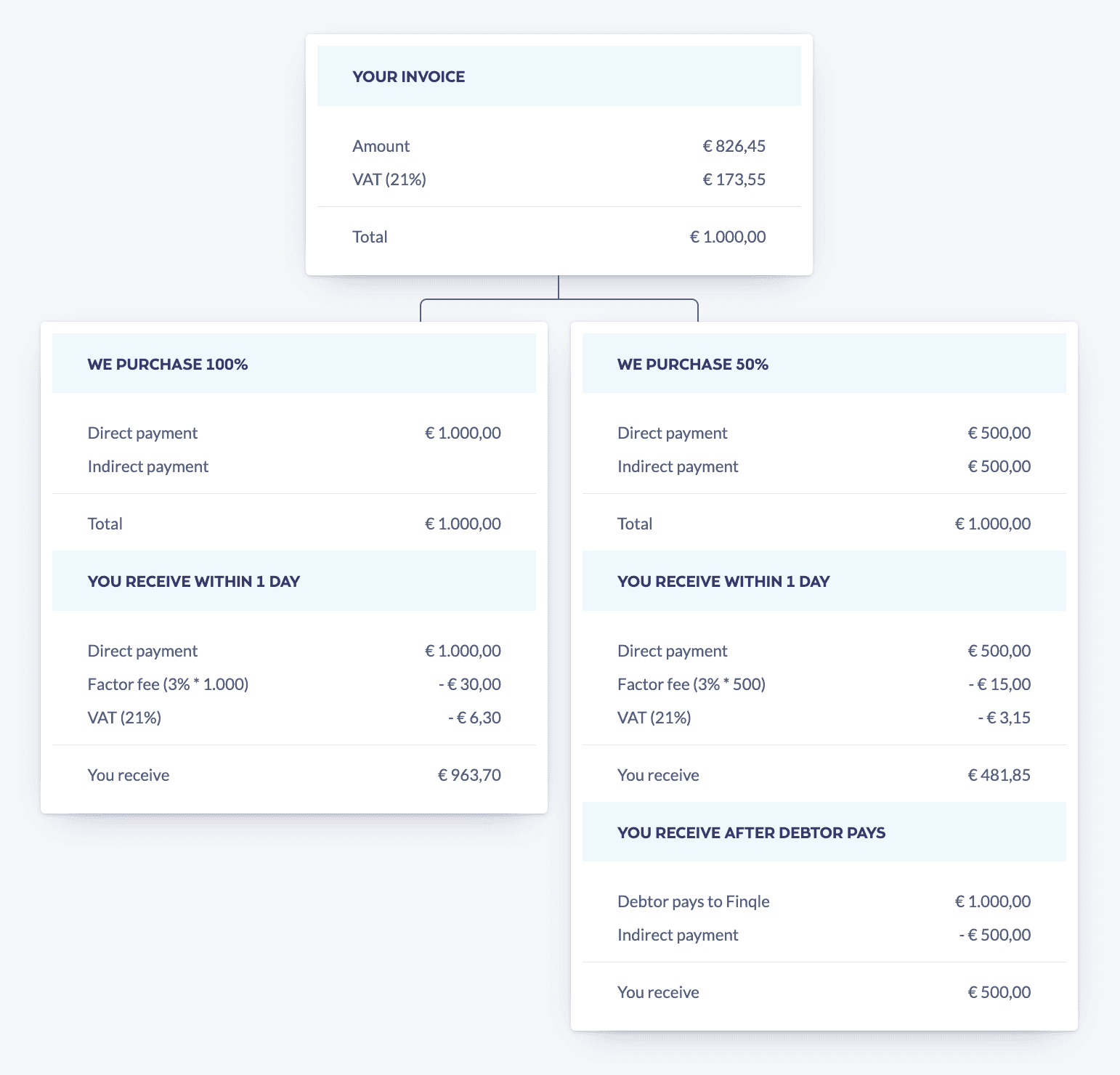

We usually purchase 100% of your invoice including VAT and pay out that amount minus our factor fee straight into your bank account. In some cases, if the client wishes so, we can purchase a part of your invoice. The remainder will then be paid when the debtor settles the invoice. We call this direct and indirect payment. Either way, the whole invoice is assigned, and you only pay for the purchase of the direct payment amount.

For the following example, imagine a factor fee of 3% *. That will give us the following two calculation examples:

*our fee varies between 1 and 5% depending on several variables

Finqle vs traditional banks

Unlike traditional banks with legacy systems and standardized products, Finqle provides customizable services and automated workflows.

Finqle vs traditional factoring companies

Finqle offers a modern, tech-driven approach to factoring, setting it apart from traditional factoring companies.

Factoring vs a loan

Factoring is not a loan. Therefore, it offers an advantage on your balance sheet: you do not incur short-term or long-term debt through factoring. In contrast, with a loan, this is the case.